In the realm of real estate, a successful transaction hinges on transparency and disclosure. One crucial element in this process is the seller’s disclosure, a document that furnishes potential buyers with essential information about the property under consideration.

This disclosure serves as a comprehensive and impartial source of knowledge, empowering buyers to make well-informed decisions while mitigating the risk of future disputes. By revealing important facts such as repair history, past pest infestations, and other condition-related issues, sellers shield themselves from liability after the sale, while also providing buyers with the opportunity to negotiate in good faith.

Various types of disclosure forms exist, tailored to residential or commercial properties, each addressing the unique complexities within their respective sectors. Understanding and adhering to local laws regarding seller’s disclosures is imperative, as non-compliance can lead to legal consequences and financial liabilities.

By obtaining and reviewing the seller’s disclosure early in the process, buyers can gain a comprehensive understanding of the property and safeguard themselves from potential risks or surprises.

This article explores the significance of seller’s disclosure, the available forms, the benefits it offers, and the potential consequences of non-compliance.

Key Takeaways

- Sellers disclosure provides important information about the condition of a home to potential buyers, helping them make informed decisions and prevent disputes in the future.

- There are different types of sellers disclosure forms for residential and commercial properties, with commercial property disclosure being more detailed due to the complexity of business structures.

- Standard real estate disclosures include information about lead paint risks, property condition and improvements, natural hazards, and other required disclosures based on state laws.

- Sellers disclosure protects both buyers and sellers from unknown problems with the property, allows for negotiation in good faith, and helps sellers identify and disclose potential problems through home inspections.

Importance of Sellers Disclosure

The importance of a seller’s disclosure cannot be overstated in a smooth real estate transaction. This document plays a crucial role in providing potential buyers with essential information about the condition of a home. It allows sellers to disclose facts that buyers should be aware of before making an offer, such as repair history, pest infestations, and other issues that may affect the property.

By providing this information upfront, sellers enable buyers to make informed decisions and prevent disputes in the future. Additionally, sellers are protected from liability after selling their homes, as they have fulfilled their duty of disclosure.

Types of Sellers Disclosure Forms

There are three main types of sellers disclosure forms that are commonly used in real estate transactions.

The first is the residential property disclosure form, which covers issues with the home’s structure, appliances, plumbing, and electrical systems. This form is typically used for residential homes and provides buyers with detailed information about the condition of the property.

The second type is the commercial property disclosure form, which is used for commercial properties. This form includes information about utility systems, environmental compliance, and legal/ownership history. Commercial property disclosures are often more detailed due to the complexity of business structures and the unique considerations that come with commercial properties.

Lastly, there are standard real estate disclosures that are required in most transactions. These include disclosures about lead paint risks for homes built before 1978, transfer disclosure statements that provide details about the property’s condition and recent improvements, and natural hazards disclosure that informs buyers of potential hazards like flooding and earthquake fault lines. Additional sellers disclosures may be required depending on state laws.

It is important for sellers to understand and comply with these disclosure requirements to avoid penalties and ensure a smooth real estate transaction.

Standard Real Estate Disclosures

Standard real estate disclosures are a crucial component of a successful real estate transaction, providing buyers with essential information about the property’s condition and potential risks. These disclosures ensure transparency and protect both parties from future disputes. Here are some common standard real estate disclosures:

| Disclosure | Description |

|---|---|

| Lead Paint Disclosure | Required for homes built before 1978 to inform buyers of potential lead paint hazards. |

| Transfer Disclosure Statement | Provides details about the property’s condition, recent improvements, and any known issues. |

| Natural Hazards Disclosure | Informs buyers about potential hazards like flooding, earthquake fault lines, or wildfire zones. |

| Additional Disclosures | Depending on state laws, sellers may be required to disclose other information such as mold, radon, or structural problems. |

Benefits of Sellers Disclosures

Sellers disclosures offer numerous advantages to both buyers and sellers involved in a real estate transaction.

For buyers, it provides a full understanding of the property they are purchasing and any associated risks. They have access to information about the condition of the home, including repair history and potential issues. This allows them to make informed decisions and negotiate in good faith based on full disclosure.

Sellers, on the other hand, benefit from disclosing all legal and financial facts about the property. By doing so, they protect themselves from post-sale liabilities and potential lawsuits. Sellers disclosures also help sellers identify and disclose potential problems through home inspections, ensuring a smoother transaction for all parties involved.

Providing Sellers Disclosure Early

To ensure a smooth real estate transaction, it is crucial to provide the seller’s disclosure early in the process. By providing the disclosure statement as soon as the property is listed or when a contract is signed, buyers have the opportunity to review the information and make informed decisions.

Generally, sellers should provide the disclosure within five business days of executing a purchase agreement. It is important to comply with local laws, which may require additional disclosures such as seismic hazard disclosures.

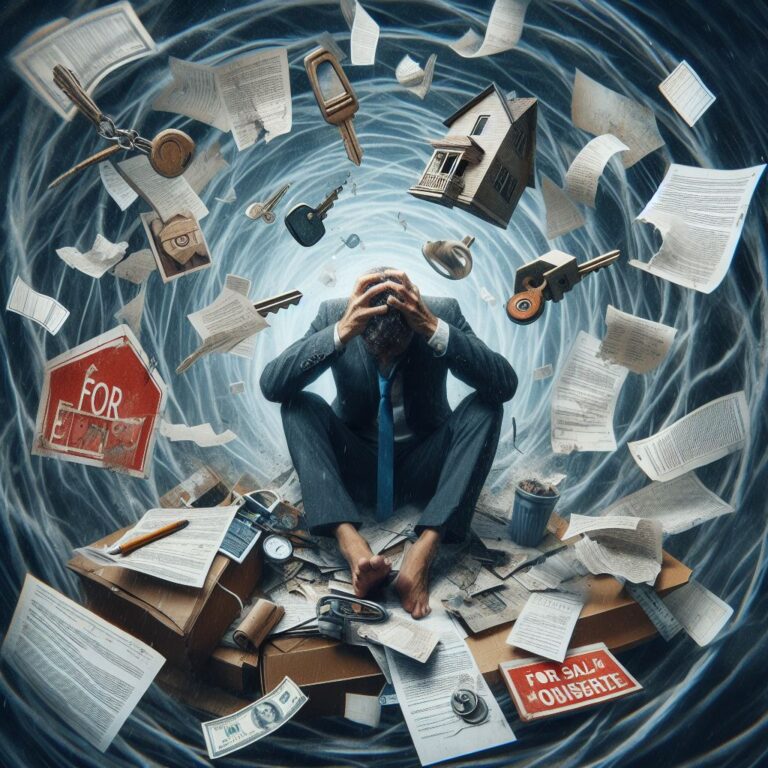

Failure to provide the seller’s disclosure can have serious consequences, including lawsuits from buyers, financial penalties or fines, delay or cancellation of the sale, negative impact on the seller’s reputation, and difficulty in future real estate transactions.

Therefore, it is crucial for sellers to obtain and provide the seller’s disclosure early in order to protect both parties and ensure a smooth transaction.

Consequences of Non-Compliance

Failure to comply with disclosure requirements can result in legal consequences or financial liabilities for sellers. Non-compliance can lead to lawsuits from buyers who may claim that they were misled or suffered financial losses due to undisclosed issues with the property. Sellers may also face financial penalties or fines imposed by regulatory authorities for failing to provide the necessary disclosures.

In some cases, non-compliance can even lead to the delay or cancellation of the sale, causing significant inconvenience and potential financial losses for both parties involved. Moreover, the reputation of the seller may be negatively impacted, making it more difficult to engage in future real estate transactions.

To avoid these consequences, sellers must ensure they are aware of and comply with all disclosure requirements in their jurisdiction.

Obtaining a Seller’s Disclosure

When seeking a seller’s disclosure, potential buyers can request the document from the seller or their real estate agent. It is important for buyers to review the document thoroughly to ensure they have a clear understanding of the property’s condition and any potential issues. If buyers have any questions or concerns about the disclosure, it is advisable to seek professional advice from a real estate attorney or inspector.

Hiring a home inspector can provide an additional layer of protection by conducting a thorough inspection of the property and identifying any hidden problems. It is also recommended for buyers to keep a copy of the seller’s disclosure for future reference, as it can serve as a valuable resource throughout the real estate transaction.

Understanding Local Laws

What are the important considerations when it comes to understanding local laws in relation to seller’s disclosure in a real estate transaction?

- Familiarize Yourself with State and Local Laws: Each state has its own laws regarding seller’s disclosure requirements. It is crucial to familiarize yourself with these laws to ensure compliance. Additionally, some local jurisdictions may have additional disclosure requirements that you need to be aware of.

- Consult with an Attorney or Real Estate Professional: To navigate the complexities of local laws, it is advisable to seek guidance from an attorney or a real estate professional who is well-versed in the specific regulations of your area. They can provide you with the necessary information and help you understand your obligations as a seller.

- Stay Updated on Changes in Regulations: Laws regarding seller’s disclosure can change over time. It is important to stay informed about any updates or amendments to ensure that you are following the most current requirements. This can help you avoid potential legal issues and protect your interests in the transaction.

Role of Home Inspections

A crucial aspect of the real estate transaction process is the role of home inspections. Home inspections play a vital role in providing buyers with a detailed understanding of the property’s condition.

During a home inspection, a qualified professional thoroughly examines the property, including its structural components, electrical systems, plumbing, and other important features. The inspector looks for any potential issues or defects that could affect the property’s value or pose a risk to the buyer.

The findings of the home inspection are typically documented in a detailed report, which can be used by the buyer to negotiate repairs or adjustments to the purchase agreement.

Home inspections are an essential step in the real estate transaction process, ensuring that buyers have a clear understanding of the property they intend to purchase.

Ensuring a Smooth Real Estate Transaction

To ensure a smooth real estate transaction, sellers must prioritize open communication and diligent preparation. Here are three key steps to follow:

- Communicate openly: Sellers should maintain clear and transparent communication with buyers throughout the transaction process. This includes promptly responding to inquiries, providing necessary documentation, and addressing any concerns or issues that may arise.

- Prepare the property: Sellers should take the time to thoroughly prepare their property for sale. This includes conducting necessary repairs, organizing and decluttering the space, and ensuring that all necessary paperwork and documentation are in order.

- Comply with legal requirements: Sellers must familiarize themselves with and adhere to all legal requirements and regulations pertaining to the sale of their property. This includes providing all required disclosures, such as the seller’s disclosure form, and ensuring that all necessary permits and inspections are obtained.

Frequently Asked Questions

What Should Buyers Do if They Suspect That the Seller Has Not Provided a Complete or Accurate Disclosure Statement?

If buyers suspect that the seller has not provided a complete or accurate disclosure statement, they should consult with their real estate agent or seek legal advice to understand their rights and options for recourse.

Are Sellers Required to Disclose Information About Previous Repairs or Renovations Done on the Property?

Yes, sellers are generally required to disclose information about previous repairs or renovations done on the property. This helps buyers make informed decisions and prevents disputes in the future.

Can Sellers Be Held Liable for Undisclosed Issues That Are Discovered After the Sale Is Completed?

Yes, sellers can be held liable for undisclosed issues discovered after the sale is completed. Failure to provide a seller’s disclosure may result in legal consequences, financial liabilities, and reputational damage for the seller.

Are There Any Specific Disclosure Requirements for Properties Located in Areas Prone to Natural Disasters?

Properties located in areas prone to natural disasters may have specific disclosure requirements. Sellers should provide information about potential hazards like flooding or earthquake fault lines to buyers. Failure to disclose may lead to legal consequences and reputational damage.

How Can Buyers Verify the Accuracy of the Information Provided in the Seller’s Disclosure Statement?

Buyers can verify the accuracy of the information in the seller’s disclosure statement by conducting their due diligence. This includes hiring a home inspector, reviewing property records, and seeking professional advice if needed.